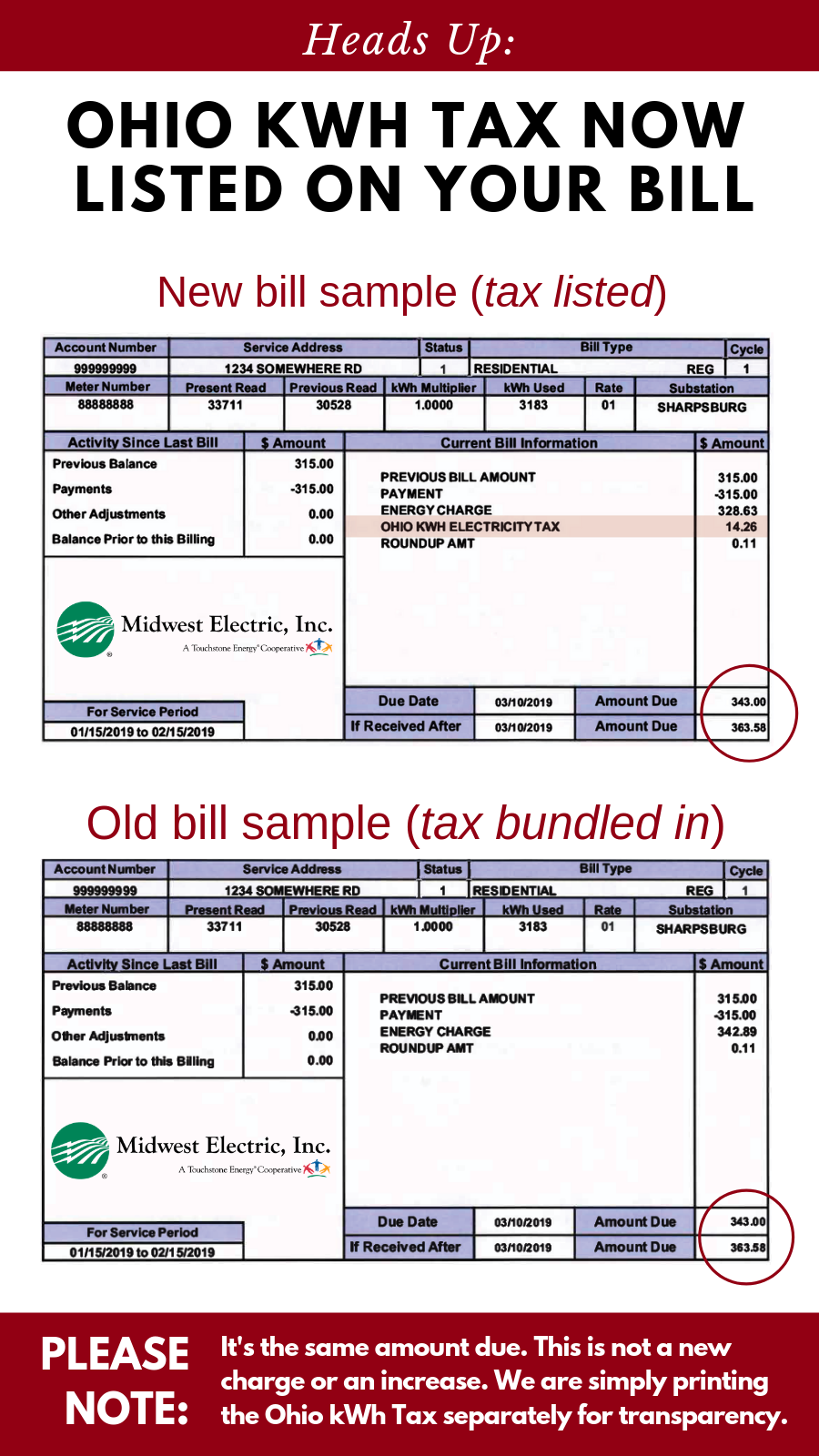

The Ohio kilowatt-hour (kWh) tax is among the highest electricity taxes in America. It’s a hidden tax; the Ohio legislature created this tax about 18 years ago, and you probably never even knew about it.

(Which is why we're listing it as a separate line item on your electric bills for transparency - see bottom for details and sample.)

It averages about $0.004 for every kWh of electricity that you use. It’s part of our electric rate that you pay every month. We collect it from you, and send it all on to Columbus where it becomes part of the state’s general revenue fund. The state does not use this revenue for energy or electricity-related issues.

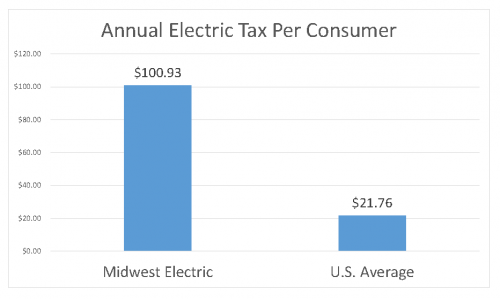

The average Midwest Electric member pays $100 a year in the kWh tax in your electric bill. The national average is $22 per year. Combined with property taxes on our distribution system, the average Midwest Electric member pays $183 a year.

As a whole, our members pay the state more than $1 million a year in the kWh tax, making it our fourth-highest expense. Throw in property taxes, and you pay about $2 million a year, making these two taxes combined our third-highest expense.

We’re all for paying our fair share. We’re community-minded; we are built by the communities we serve. Through our Community Connection Fund, our members donate $50,000 a year to area charitable causes. And our economic development revolving loan fund has provided nearly $2 million in low-interest loans to area small business.

Our concern is that Ohio’s municipal utilities do not have to pay the kWh tax OR property tax, putting us at a competitive disadvantage and forcing rural Ohio to subsidize your municipal neighbors.

(Despite the tax difference and economic difference of serving a municipal area versus a rural area, we are very competitive. When you factor in the tax difference plus the patronage cash back you receive as a Midwest Electric member, our electric cost is spot on with local municipals.)

The Ohio kWh tax also creates an incentive for towns to form a municipal electric company on paper only. They could contract the actual electric service with a utility, then the town could keep the kWh tax revenue for its local purposes. A village in northwest Ohio is attempting to do this.

Some distributed generation companies (i.e., wind) meet the definition of an electric utility when they generate, distribute, meter, and bill the consumer. The Ohio Department of Taxation has ruled that those companies should therefore pay the kWh tax. However, they’re not paying it, and they’re seeking legislation to be exempt from the tax that you have to pay.

These are just a few examples of how the Ohio kWh tax is flawed: it’s much higher than the national average, the state does not use the tax revenue for energy-related issues, it unfairly burdens rural Ohio, it creates unfair advantages for municipal utilities by exempting them from remitting the tax to the state, it incentivizes municipal electric companies to go after electric cooperative service area, and it incentivizes towns to create “paper” electric companies.

Our statewide association aims to address the Ohio kWh tax with our legislators. I wanted to take this opportunity to first educate you on our concerns. Stay tuned.

Have questions?

Please reach out to us at 800-962-3830 so we can be sure you understand the bill you receive each month. That’s the value of being a not-for-profit co-op member!